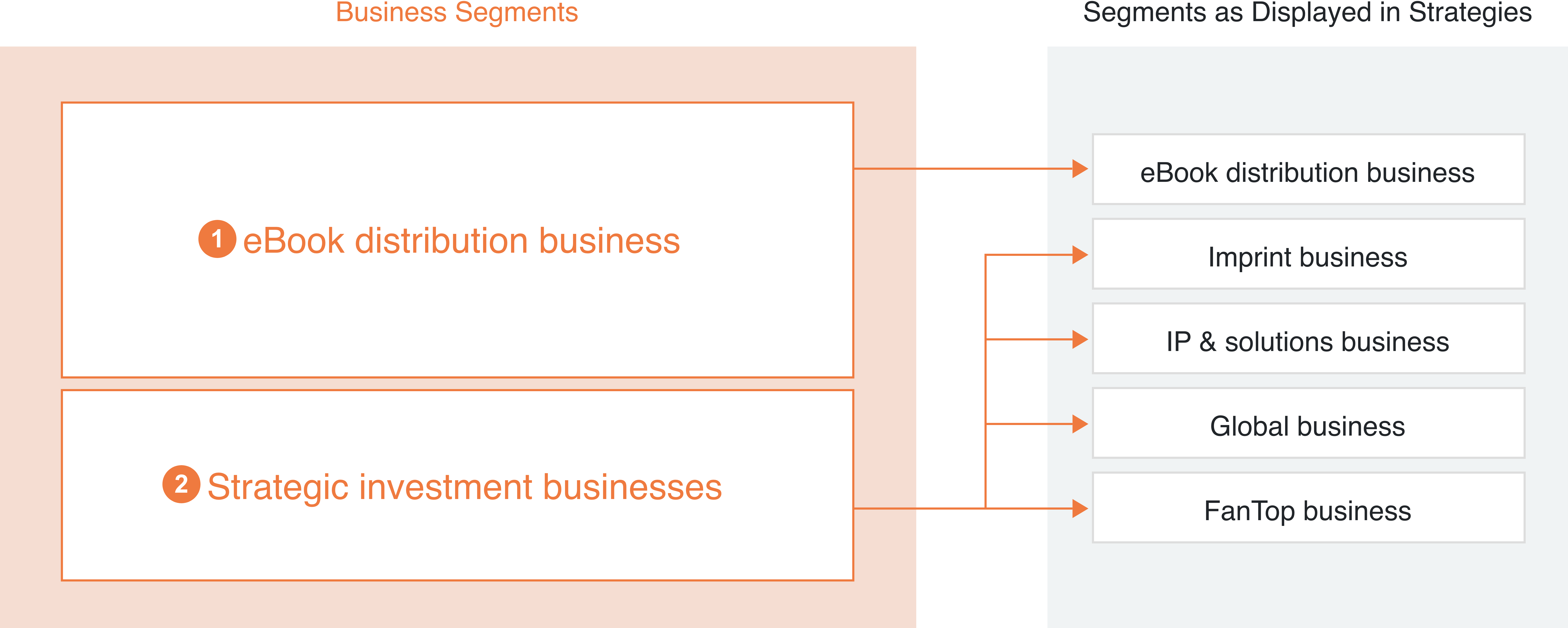

Business Model

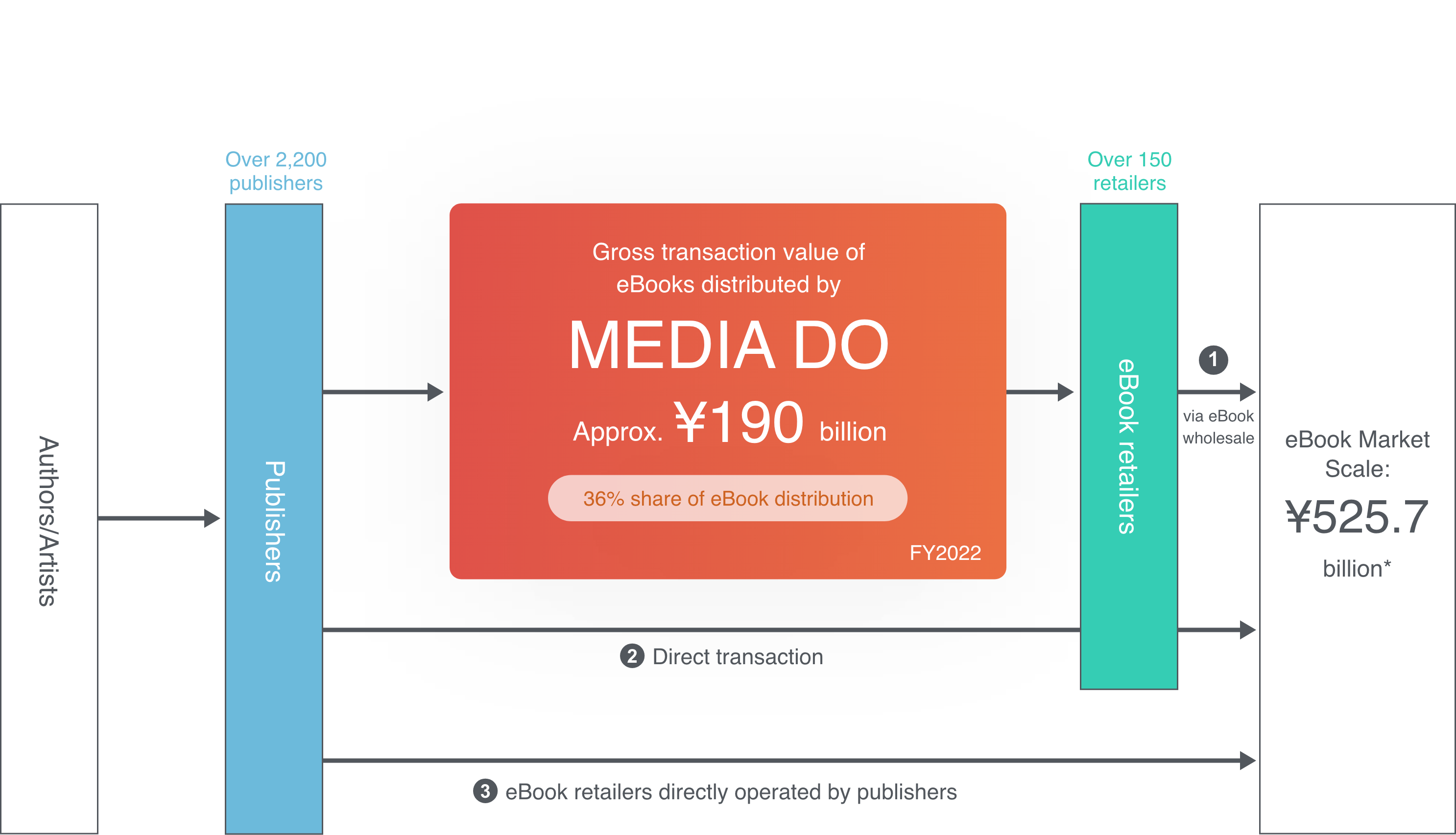

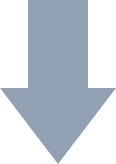

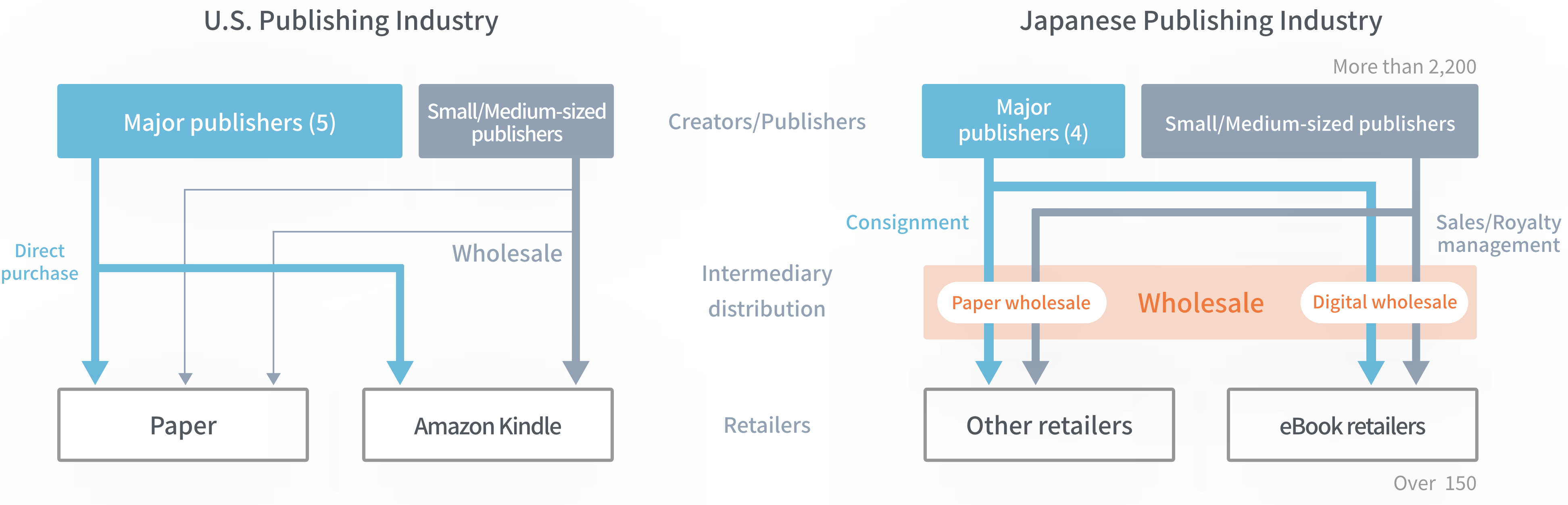

MEDIA DO develops an eBook distribution business that connects more than 2,200 publishers and over 150 eBook retailers in Japan.

* Source: eBook Market Report 2022, Impress Research Institute. Actual results for FY2021 are shown.

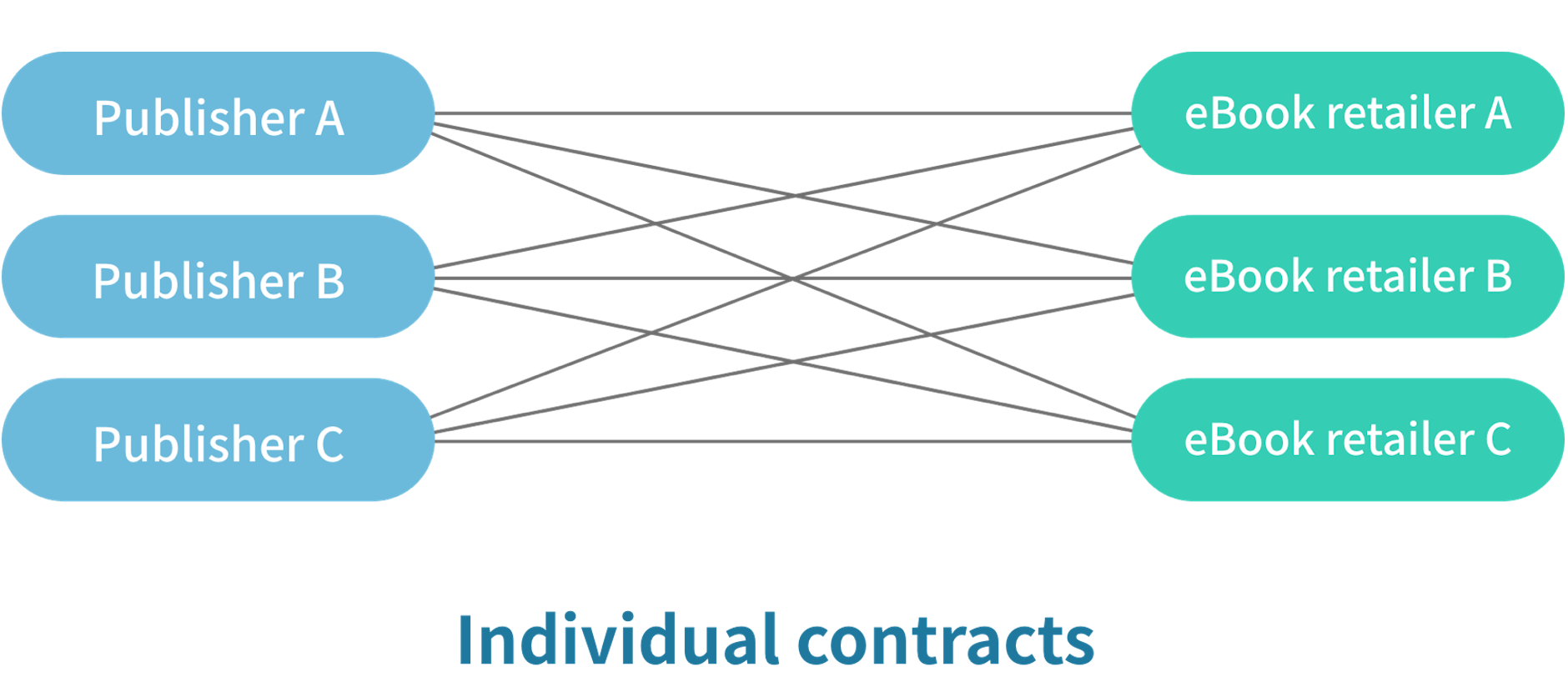

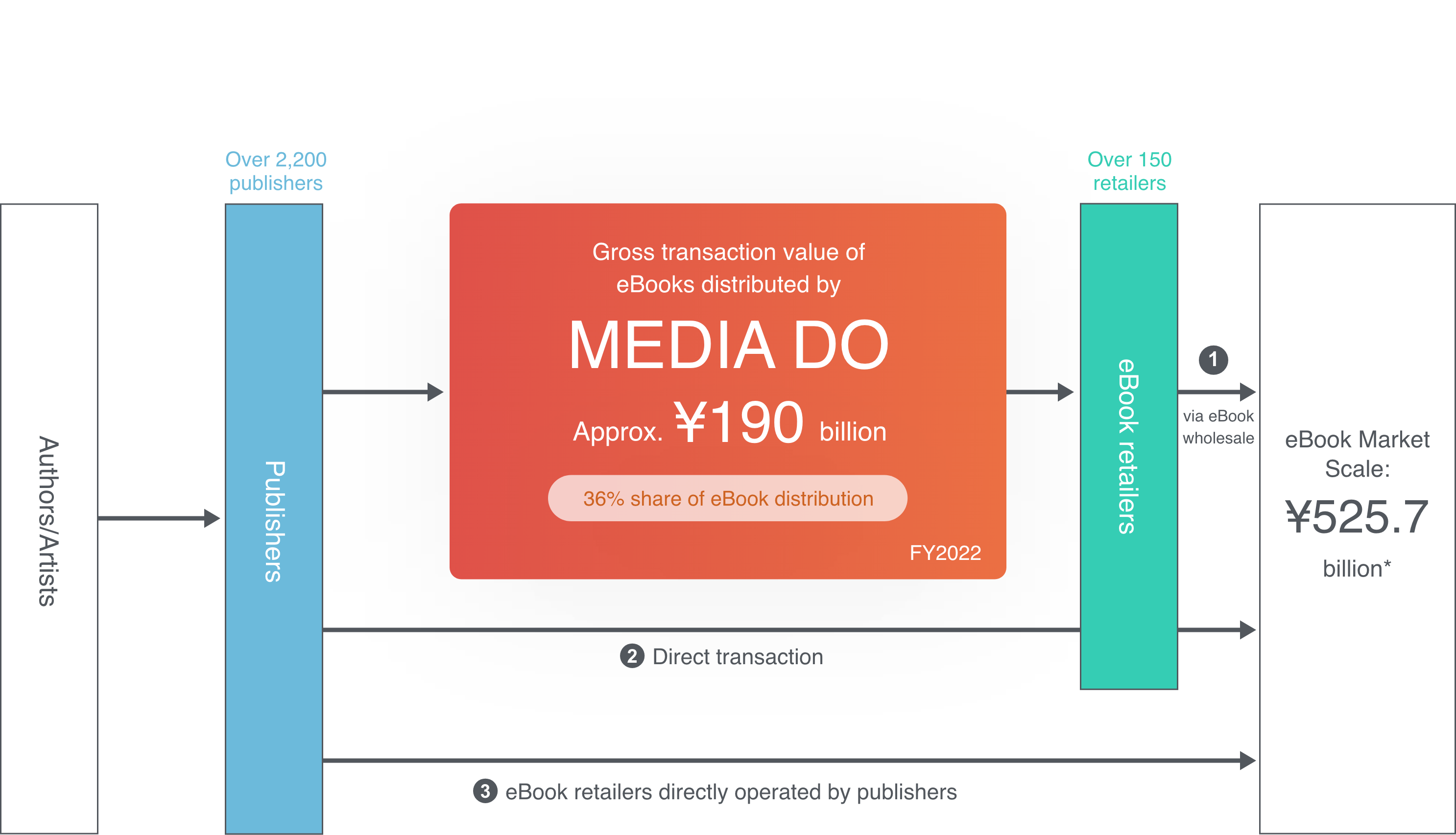

Japanese publishing industry characterized by large number of publishers and eBook retailers. Smooth distribution facilitated by various processes being handled on behalf of publishers and retailers by MEDIA DO.

Specifically, simplification of complex business flow through elimination of need for contracts between individual publishers and retailers via MEDIA DO’s functions as an intermediary.

Business Flow without MEDIA DO

Business Flow with MEDIA DO

Principal Characteristic

1. Brokering of contracts/transactions with publishers

Expansion of content lineups of eBook retailers

2. Accurate distribution of revenues to publishers and creators

Aggregation of monthly sales data of eBook retailers

3. Operation of eBook distribution system

Distribution of content to eBook retailers on behalf of publishers

4. Promotional campaigns

Discounts, free offerings, and other promotions provided through collaboration with publishers and eBook retailers

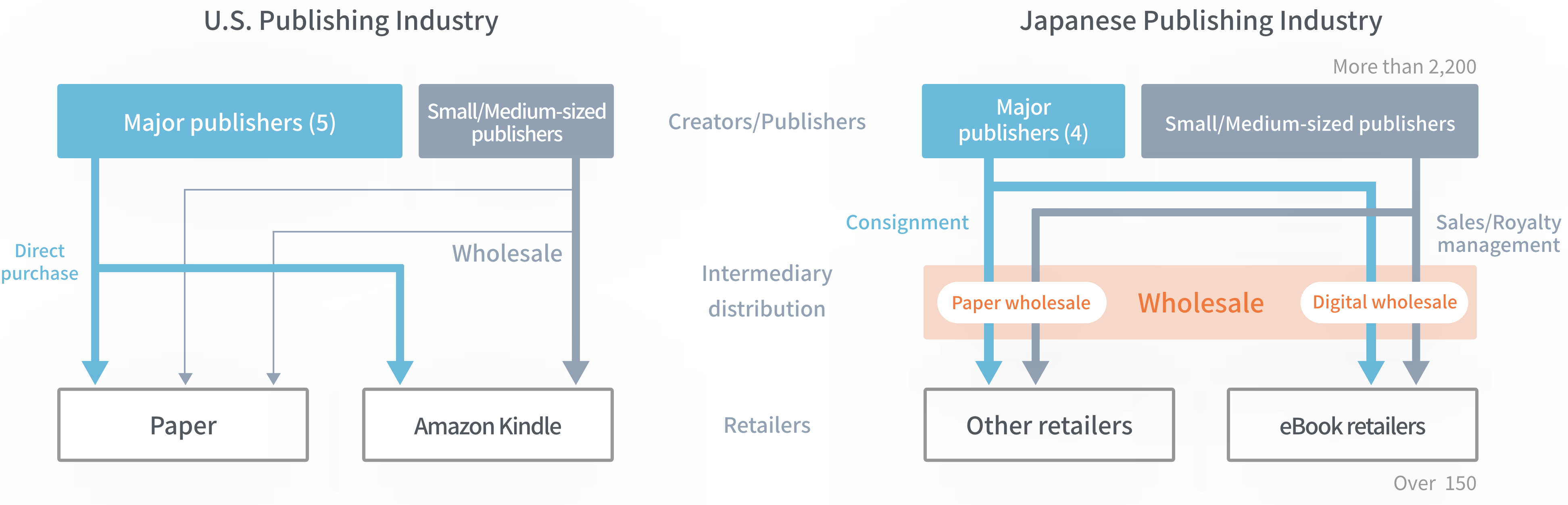

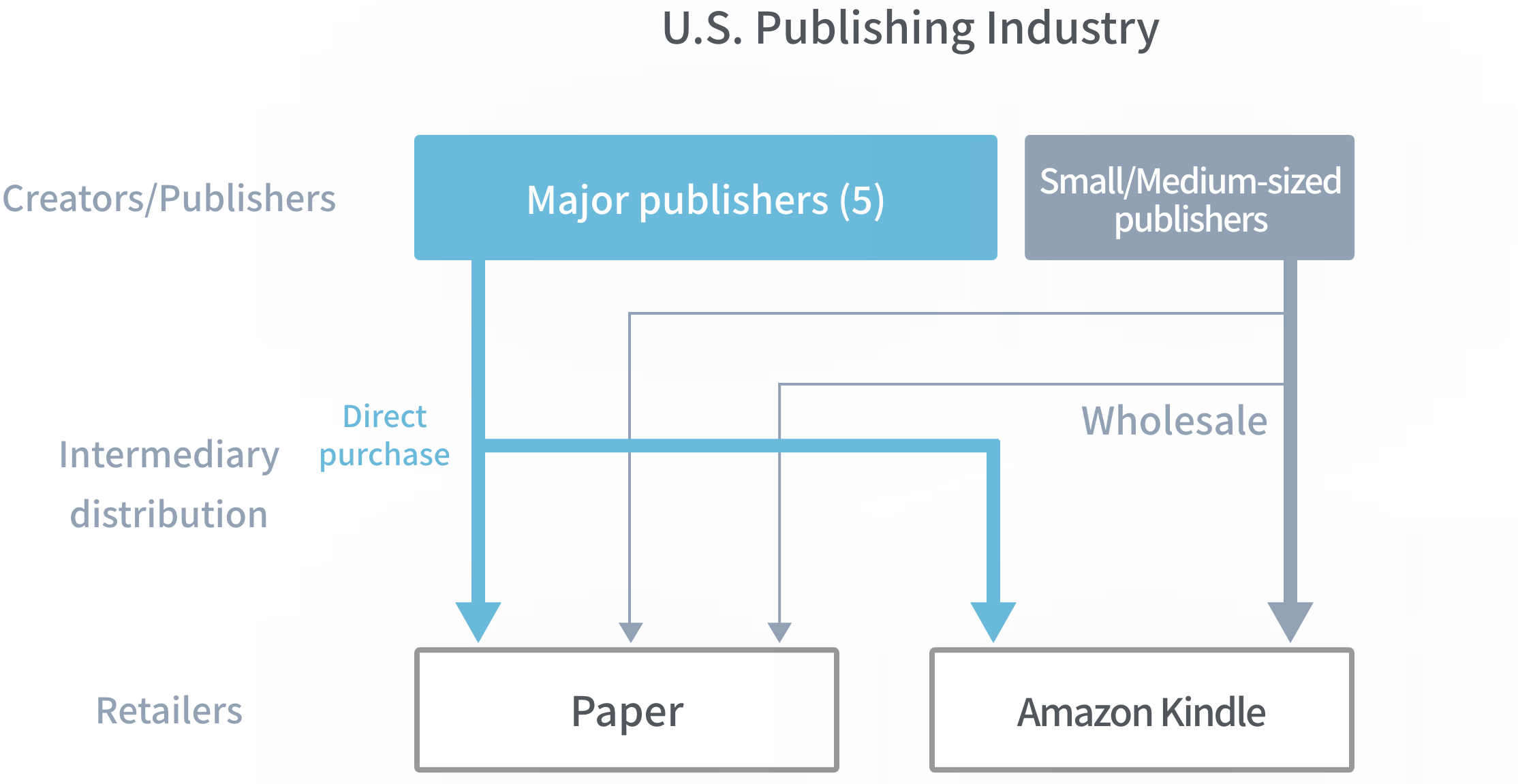

(Reference) Differences between U.S. and Japanese Publishing Industries

ー Differences Creating Need for eBook Wholesalers

1. Industry environment

- Oligopoly situation in U.S. publishing market created by existence of only five major publishers and large market share of 状況 Kindle among eBook retailers, eliminating the necessity of complicated procedures that produce a need for wholesalers and creating an environment conducive to direct transactions

- Large presence of small, independent publishers in Japanese market when compared to U.S. market, creating a need for wholesalers as it is difficult for such publishers to handle all paper book and eBook distribution processes on their own

2. Frameworks

- Books purchased directly from publishers by retailers in U.S. market (no returns)

- Paper book transactions by publishers, wholesalers, and retailers in Japanese market made based on consignment system allowing for retailers to return unsold books and thereby procure books without assuming inventory risks

- Need for frameworks for managing diverse transactions and small localized campaigns arising due to the fact that most eBook sales are performed through eBook retailers

Need for wholesalers by both publishers and retailers in Japan due to large number of industry players and complicated nature of procedures

MEDIA DO’s Strengths

The MEDIA DO Group’s core eBook distribution business has a rare position in the publishing industry as a wholesaler. By capitalizing on this position and on the expertise and cutting-edge technologies amassed thus far, we can provide comprehensive distribution support.

Position

・Core distribution functions

・Dominating share

・Global presence

・Industry support

- Gross transaction value (No. 2 in the world) Approx. ¥190.0 billion

- Total managed eBook distributor campaigns (FY2021) more than 16,000. Number of content items distributed through campaigns (FY2021) more than 1.5 million

- Domestic eBook distribution market share*1 36%. Unrivaled position as an intermediary between more than 2,200 publishers and over 150 eBook distributors

- Ability to conduct transactions with more than 99% of Japanese publishers offering eBooks

- Only Asian company to dispatch an employee to serve as co-chair of the Publishing Business Group of the World Wide Web Consortium (W3C)*2. Appointment of the first W3C evangelist from Japan

Technology

・Exceptional development capabilities

・One-stop service for system and data management and other services

- Engineer team Approx. 150 members*3

- In-house development of all core systems. Ranging from eBook distribution platforms to NFT management systems using blockchain technology

- Amount of content supplied through eBook distribution system More than 900 million files per month

- Launch of Japan’s first product using Flow blockchain, which boasts the highest number of user-to-user NFT transactions*4

- Release of Japan’s first 3D and augmented reality (AR) functions for an NFT marketplace viewer er app (February 2022)

*1 Calculated by dividing our gross transaction value in FY2022 by the total transaction value in the market as a whole

*2 Organization promoting international standardization of internet technologies

*3 Represents 30% of total employee base

*4 Source: Blockchains by NFT Sales Volume (All-time), CryptoSlam!

Pursuit of market growth by leveraging strengths to streamline industry operations and transform business models