Risk ManagementSUSTAINABILITY FOR THE MEDIA DO GROUP

Basic Policy

The MEDIA DO Group has established risk management regulations to mitigate risks and minimize the potential losses should risks be realized. In addition, the Sustainability Committee has been put in place to help identify, asses, and combat risks with the potential to impact the ongoing growth and business activities of the Group. This committee meets once a quarter, in principle, and the results of its examinations and discussions are reported to management. Based on these reports, management examines the relative weight of risks from its perspective to prioritize the risks needing to be addressed. Identified risks are categorized as either business strategy risks or operational risks.

| Business Strategy Risks | Business strategy risks represent the potential that the Company will be unable to achieve the desired results or benefits of its management policies or business strategies. Measures for countering these risks are to be formulated based on the scope and extent of their potential impact on the ongoing growth of the Company. |

|---|---|

| Operational Risks |

Operational risks refer to the risk of operational phenomenon, obstructions, or losses occurring during the course of implementing business strategies. These risks shall be limited to a predetermined level during the course of business activities. |

For risks judged to be material, response measures and countermeasures are examined and discussed after various levels, including the business, corporate, and senior management levels. The Sustainability Committee monitors progress in such measures as it works to promote ongoing improvements. In addition, Audit & Supervisory Board members attend meetings of the Board of Directors, review important documents, and coordinate with the accounting auditor to confirm the effectiveness of measures implemented in response to high-priority risks. Furthermore, the Company establishes compliance-related regulations, defines the roles and regulations to be observed by Group officers and employees, and conducts internal audits to confirm the status of compliance.

Risk Management Cycle

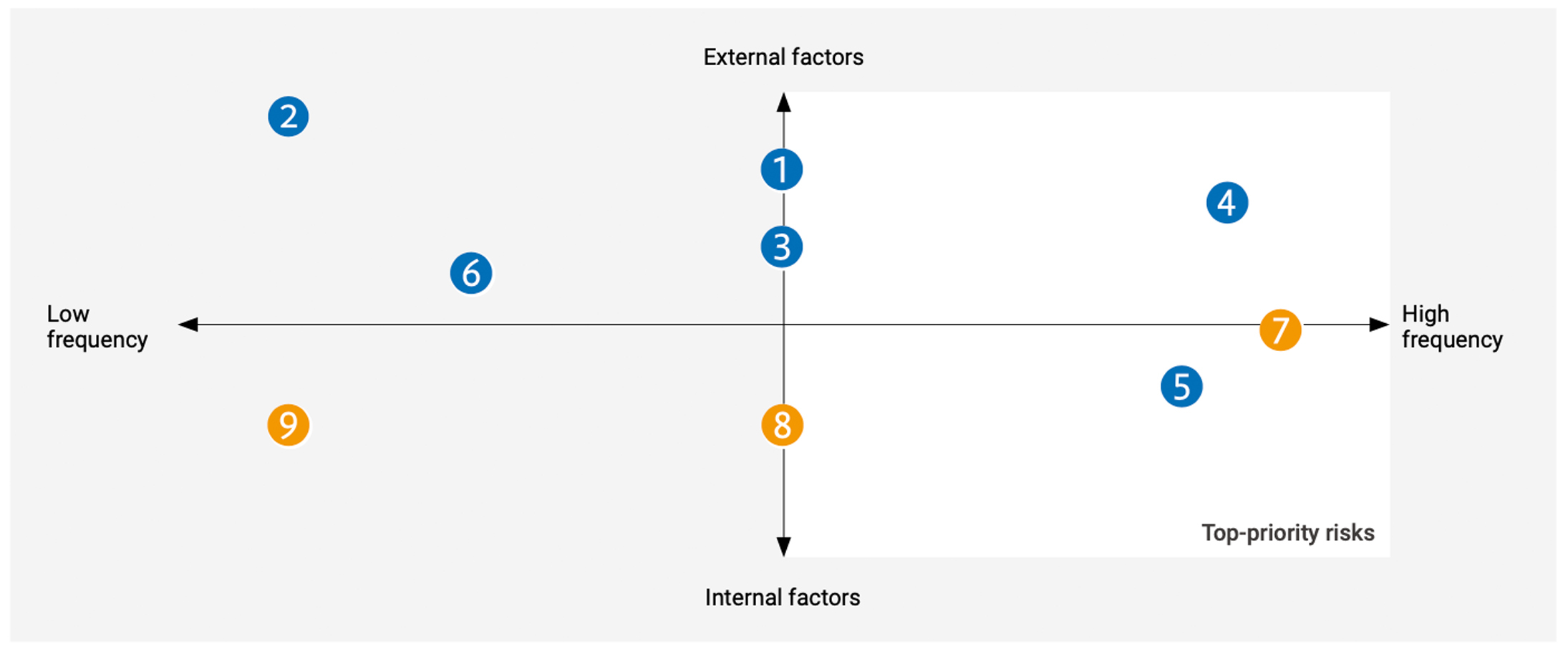

Risk Assessment Map

Major Business Risks and Scope of Impacts

| Recognized Risk | Scope of Impact | Degree of Impact | Supplementary Information | ||

|---|---|---|---|---|---|

| Business Strategy Risks | ① | Risks related to growth potential of the eBook industry |

|

Potential for medium to large impacts (hundreds of millions of yen to billions of yen) on performance | The eBook market is expected to grow going forward, and the Company is committed to improving its systems and services to contribute to this growth. |

| ② | External factor (natural disasters, etc.) risks |

|

Potential for medium to large impacts (hundreds of millions of yen to billions of yen) on performance | In response to the COVID-19 pandemic, the Company continued its business activities with approximately 30% of its employees teleworking full time. Conversely, the Company recognizes the need to establish business continuity plans and crisis response manuals and take other exhaustive measures to limit the potential impact of various external factors, such as pandemics, on business activities. | |

| ③ | Risks of piracy websites, etc. |

|

Potential for medium to large impacts (hundreds of millions of yen to billions of yen) on performance | There are currently numerous small to medium-sized piracy websites based overseas. Though some of these websites have been closed, the number of accesses to such websites are on the rise, necessitating a joint response by the publishing industry and government agencies. | |

| ④ | Risks related to dependence on specific suppliers |

|

Potential for medium to large impacts (hundreds of millions of yen to billions of yen) on performance | The Company does not engage in frequent conditions negotiations with suppliers, but conditions are regularly reviewed from a two-way perspective. | |

| ⑤ | Systems and information security risks |

|

Potential for medium impacts (hundreds of millions of yen) on performance | Over the past year, there were no incidents resulting in economic losses and no incidents of information leakage. The Company recognizes the need for a Groupwide effort to enhance security systems and pursue ongoing improvements in order to prevent future incidents and information leaks. | |

| ⑥ | Investment and impairment risks |

|

Potential for medium impacts (hundreds of millions of yen) on performance | In the six months ended August 31, 2021, an impairment loss amounting to ¥394 million was recorded under extraordinary loss in relation to consolidated subsidiary Nagisa, Inc. This loss was recorded in response to changes in the operating environment pertaining to internet advertising regulations for operators of digital platforms, which affect the core manga app business of Nagisa. Based on these changes, an impairment loss was recorded following an examination of the progress toward the initial earnings forecast for this business and an assessment of the recoverability of goodwill. | |

| Operational Risks | ⑦ | Human resource recruitment risks |

|

Potential for medium impacts (hundreds of millions of yen) on performance | No major delays to business activities have been incurred as a result of human resource recruitment issues, but demand is already rising for recruitment of engineers and other human resources to fuel future growth. |

| ⑧ | Internal control risks |

|

Potential for medium impacts (hundreds of millions of yen) on performance | No corporate governance issues have occurred at this point in time, but the Company recognizes the need to enhance internal control systems in order to prevent future issues. | |

| ⑨ | Risks related to dependence on specific individuals |

|

Potential for medium impacts (hundreds of millions of yen) on performance | The Company is not currently dependent on any specific individuals. However, it is still necessary to develop succession plans and otherwise prepare for unforeseen events. | |